When you take a pill for high blood pressure, diabetes, or an infection, there’s a good chance the active ingredient inside came from a factory in China. About 80% of the world’s active pharmaceutical ingredients (APIs) are made there. That’s not a small number-it’s the backbone of most generic medicines sold globally. But behind the low prices and massive output lies a growing tension: Can you trust the quality?

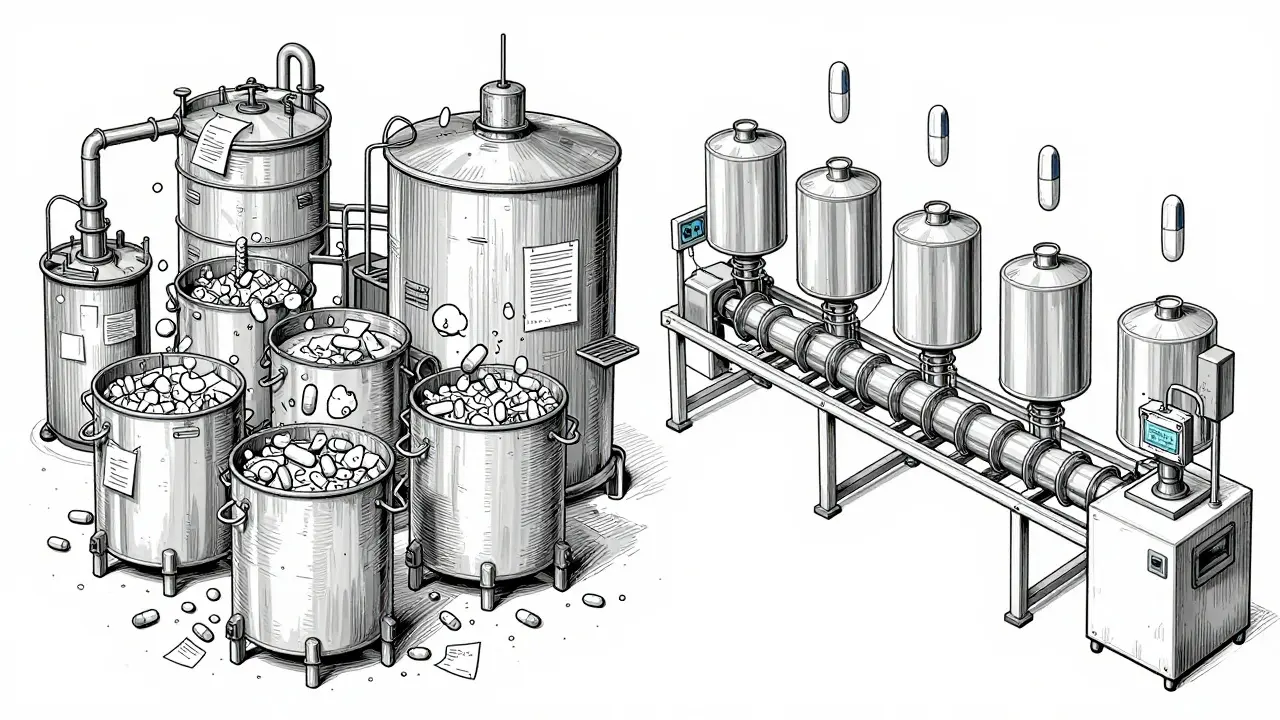

Why China Dominates Generic Drug Production

China didn’t become the world’s top API producer by accident. After joining the World Trade Organization in 2001, the government poured billions into building chemical plants, training engineers, and cutting red tape. By 2023, China produced over $185 billion worth of pharmaceuticals, with generics making up nearly 70% of domestic sales. But exports tell a different story: while China makes 80% of APIs, it only exports 5-7% of finished drug pills. That’s because most finished medicines made with Chinese APIs are assembled in India, the U.S., and Europe. The secret to China’s dominance? Cost and scale. A kilogram of generic API like metformin or amoxicillin costs $50-$150 in China. In the U.S. or Germany, the same amount runs $200-$400. Chinese factories can produce 500 to 2,000 metric tons of a single API per year-enough to supply millions of prescriptions. They do this by controlling nearly 70% of the production chain, from raw chemicals to final intermediates. This vertical integration cuts costs and speeds up production.The Quality Gap: What Goes Wrong

Lower cost doesn’t always mean lower quality-but in China’s generic drug industry, it often does. The U.S. Food and Drug Administration (FDA) has issued warning letters to Chinese manufacturers for the same problems year after year: poor lab controls, unvalidated processes, and falsified data. In 2022-2023, 78% of inspections found inadequate laboratory controls. Over half of the facilities failed to prove their manufacturing methods were consistent. One major issue is outdated technology. While U.S. and European plants increasingly use continuous manufacturing-where drugs are made in a steady, automated flow-65% of Chinese API production still relies on batch processing. Batch methods are cheaper but harder to control. A single batch can have inconsistent purity, leading to pills that are too weak or too strong. In 2023, a study found 12.7% of Chinese API samples failed purity tests. Compare that to just 1.8% for U.S.-made APIs and 2.3% for European ones. Then there’s the data integrity problem. Some labs have been caught manipulating test results, deleting records, or retesting samples until they pass. A 2023 survey by PhRMA found 37% of U.S. drugmakers reported documentation falsification from Chinese suppliers. One company, Zydus Pharmaceuticals, recalled 1.2 million bottles of blood pressure medication in 2023 because the API from China’s Huahai Pharmaceutical was under-potent.Regulatory Reforms-Too Little, Too Late?

China’s own regulator, the National Medical Products Administration (NMPA), launched the Generic Consistency Evaluation (GCE) program in 2016. The goal? Make sure Chinese generics work just like the original branded drugs. It sounds good. But as of 2024, only 35% of approved generics have completed the evaluation. That means two-thirds of the pills sold in China-and exported worldwide-haven’t been proven to match the real thing. The NMPA has shut down 4,500 non-compliant factories since 2018, cutting the number of generic drug manufacturers from 7,000 to 2,500. That’s progress. But the remaining plants still operate under weaker standards than the FDA or European Medicines Agency (EMA). For example, Chinese GMP rules require less frequent environmental monitoring and allow longer data retention periods. Western companies trying to source from China often spend 18-24 months just adapting their quality systems. Pfizer’s joint venture with Huahai took 36 months and $22 million in upgrades before the FDA approved the supply chain.

Who’s Really at Risk?

It’s easy to think this is just a problem for big pharmaceutical companies. But it’s not. When APIs fail, patients suffer. A 2024 Reddit thread from r/pharmaceutical featured a quality assurance specialist who said they had to retest 37% of Chinese-sourced metformin samples-compared to only 8% for Indian-sourced ones. That’s not just a cost issue. It’s a safety issue. If a batch of diabetes medication is too weak, blood sugar spikes. Too strong, and patients risk hypoglycemia. The U.S. gets 88% of its APIs from overseas, with China supplying 28% of those facilities. That’s a massive dependency. Former FDA Commissioner Dr. Andrew von Eschenbach called it a “national security vulnerability.” If trade flows stop-due to politics, natural disaster, or pandemic-90% of essential medicines could be at risk. The 2024 Neurology Advisor warned: “Trade disruptions could leave American patients at risk.”The Indian Connection

India is often seen as the global leader in generic drugs. But here’s the catch: India imports 65% of its APIs from China. That means most Indian-made pills rely on Chinese ingredients. When India recalls a batch of antibiotics or heart medication, the root cause is often a faulty API from China. India’s strength isn’t in making APIs-it’s in turning them into pills and packaging them efficiently. China makes the raw material. India turns it into medicine. The U.S. and Europe buy the finished product. This creates a dangerous chain. If China’s API quality slips, the problem spreads through India and into every country that buys Indian generics. Yet, few countries are auditing Chinese factories directly. The FDA inspects Chinese facilities at one-tenth the rate of U.S. plants, according to former FDA Commissioner Dr. Margaret Hamburg. Why? Limited access, language barriers, and political pressure.

All Comments

Coral Bosley January 20, 2026

It’s not just about pills. It’s about trust. When your grandma takes her blood pressure med and suddenly collapses because the batch was under-potent, no spreadsheet or cost analysis justifies that. We’ve outsourced our health to a system that prioritizes speed over safety, and now we’re paying in hospital bills and grief.

Steve Hesketh January 21, 2026

Let me tell you something-this isn’t just a Western problem. In Nigeria, we buy generics from India, which buys from China, and we have no idea what’s inside. My cousin died from a fake malaria drug last year. We don’t have FDA inspections here. We just pray the pill works. The world needs to stop pretending this is someone else’s problem. This is everyone’s problem.

Sangeeta Isaac January 21, 2026

So let me get this straight-we’re all buying medicine made in a country where they still use batch processing like it’s 1987, and we’re okay with it because it’s cheaper? I mean, I get it. I’m on a fixed income too. But if my insulin fails because someone deleted a lab log, who’s gonna pay for my amputated toe? Not the CEO who got a bonus for cutting costs.

Uju Megafu January 23, 2026

OH MY GOD. I KNEW IT. I KNEW THE CHINESE GOVERNMENT WAS POISONING THE WORLD WITH MEDICINE. THIS IS A BIOLOGICAL WARFARE TACTIC. THEY’RE WEAKENING THE WEST THROUGH DIABETES AND HYPERTENSION. IT’S ALL CONNECTED. THE FEDS KNOW. THE WHO KNOWS. BUT NO ONE SPEAKS BECAUSE THEY’RE ALL ON THE PAYROLL. I SAW A VIDEO ON TIKTOK WHERE A DOCTOR IN SHANGHAI SAID ‘WE MAKE THE BAD ONES FOR YOU.’

michelle Brownsea January 23, 2026

Let’s be clear: the notion that ‘cheap medicine’ is a moral imperative is a catastrophic fallacy. When you commodify human health to the point where purity thresholds are negotiable, you don’t create access-you create systemic violence. The FDA’s inspection rate is not a bureaucratic oversight; it is a moral abdication. And those who defend this system with ‘cost-benefit analysis’ are not economists-they are enablers of bioethical collapse.

Glenda Marínez Granados January 23, 2026

So we’re all just… waiting for someone to die from a bad batch of metformin before we do anything? 🤡

Yuri Hyuga January 24, 2026

This isn’t just about supply chains-it’s about values. We’ve built a global economy that rewards efficiency over integrity. But medicine isn’t a commodity like smartphones. It’s a lifeline. Let’s not wait for a pandemic of failed generics to wake up. Let’s invest in transparency. Let’s fund audits. Let’s pay more-for safety, for dignity, for lives. 💪🌍

Amber Lane January 25, 2026

India’s the middleman. China makes the powder. India makes the pill. We buy the bottle. No one checks the powder.

Roisin Kelly January 26, 2026

It’s all a lie. The FDA is bought. The WHO is bought. Even the ‘independent’ labs are bought. They’re letting China poison us because they want us to be weak. You think they care if you live or die? They just want you to keep buying their meds and their vaccines. Wake up.

Samuel Mendoza January 26, 2026

Actually, the U.S. makes 40% of its own APIs. China’s share is inflated by re-exports through India. Stop being hysterical.

MAHENDRA MEGHWAL January 28, 2026

As a pharmaceutical professional from India, I must emphasize that while we rely heavily on Chinese APIs, our manufacturers are not passive recipients. We conduct extensive third-party audits, often at great cost. However, the systemic gaps in Chinese GMP compliance are undeniable. The challenge lies not in blaming, but in building resilient, transparent, and mutually accountable supply chains. We must elevate standards-not isolate suppliers. The patient’s life depends on it.